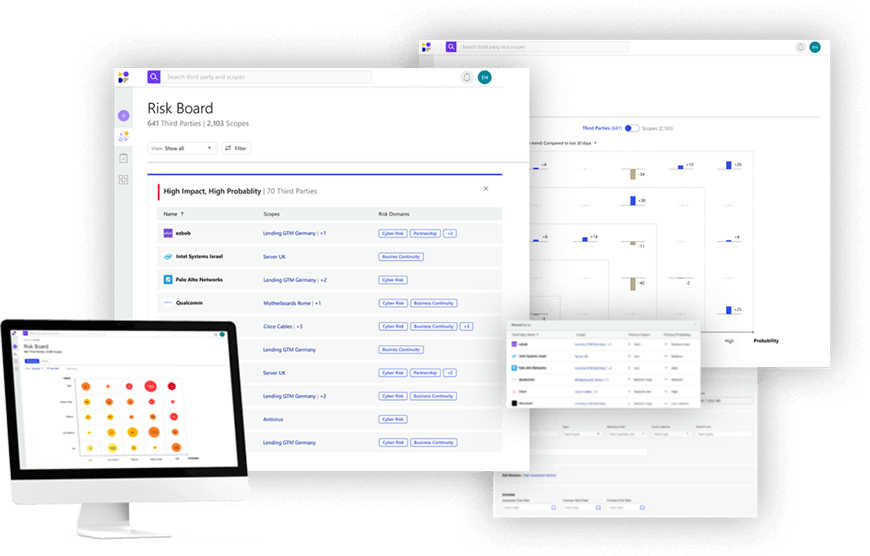

Improve any TPRM program by reducing the manual work.

Whether you are using email and spreadsheets or have a mature, fully automated and sophisticated program, Mirato can help. Significantly.

Our advanced Artificial Intelligence solutions were created and trained specifically to address the most common and difficult challenges of Third Party Risk Management.

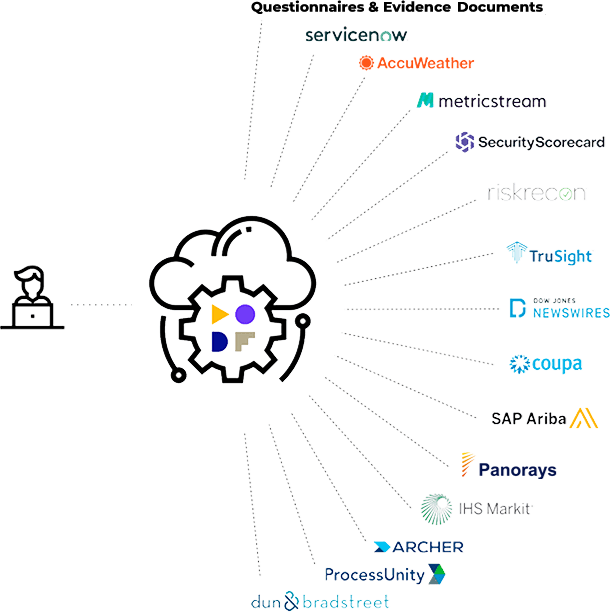

The Mirato TPRM Intelligence Platform completes your TPRM assessments using your risk appetite, your controls framework and the information you already collect.

The Mirato Questionnaire Killer automatically pre-answers your due diligence questionnaires for your third parties.This reduces time, cost, pain, and effort for everyone. Stop chasing third parties, line of business and your SMEs, and start scaling and improving your TPRM today. Mirato solutions make no "black box" decisions but enable better human decisions faster.